Articles by 안성미

안성미

-

Incheon Port Authority CEO tapped to lead Hyundai Marine

[THE INVESTOR] Creditors of Hyundai Merchant Marine have tapped Incheon Port Authority CEO Yoo Chang-keun to head the debt-ridden shipper that is under a creditor-led restructuring program.The nomination committee, comprising executives from the Korea Development Bank –- the shipper’s largest shareholder -- and other creditors, picked Yoo out of three candidates on Sept. 2. Yoo’s nomination will be finalized at the shareholders meeting on Sept. 20 after a meeting of the board of directors on Sep

Sept. 2, 2016

-

Hyundai to deploy 13 ships to cover Hanjin Shipping routes

[THE INVESTOR] Hyundai Merchant Marine, the country’s second largest container carrier, plans to deploy 13 ships on the route to the American and European continents to cover for Hanjin Shipping, Korea’s largest shipper that filed for court receivership, South Korea’s top financier regulator said on Sept. 1. “We will consider ways for the creditors to inject more funds into HMM if needed,” said Yim Jong-yong, chairman of Financial Services Commission, at a meeting with representatives from state

Sept. 1, 2016

-

South Korea clears way for Tesla’s entry

[THE INVESTOR] Tesla Motors, the US electric carmaker, received permission from the South Korean government to provide location-based services here, speeding up its entry into the Korean market. Korea Communications Commission, the state telecom and media regulator, approved Tesla Korea as a location-based service provider on Sept. 1, along with six other local companies, including Kyongnam Bank and CJ Olive Networks. Tesla Model 3Under Korean law, companies providing location-based services su

Sept. 1, 2016

-

Korean banks suffer losses in Q2 on bad shipping loans

[THE INVESTOR] South Korean banks suffered huge losses in the second quarter, largely due to financing the ailing shipping and shipbuilding industries. The combined net loss of 17 commercial and state-run banks stood at 400 billion won (US$356.69 million) from April-June period, compared to a net profit of 2.2 trillion won in the same period last year, according to data released by Financial Supervisory Service on Sept. 1. The commercial banks reported net profit of 1.6 trillion won in the cited

Sept. 1, 2016

-

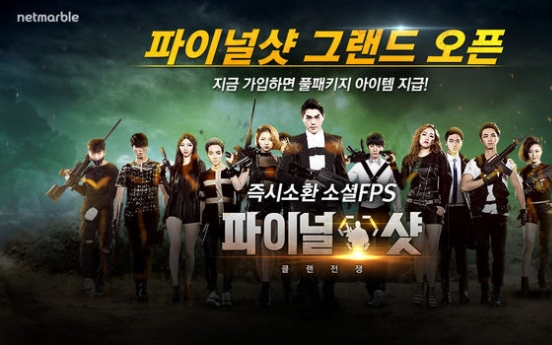

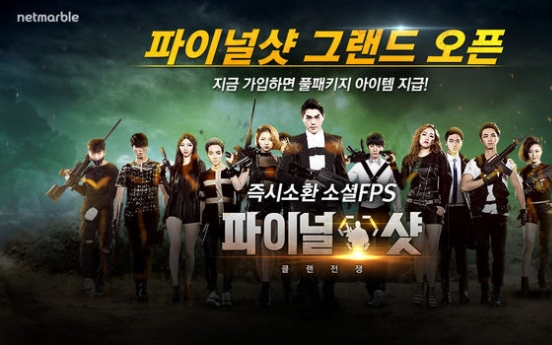

Netmarble’s ‘Final Shot’ debuts in 154 nations

[THE INVESTOR] Netmarble, South Korea’s No.1 mobile game developer, on Sept.1 announced the global launch of “Final Shot” on iOS and Android. The first-person shooter game, available in 154 countries, features various game modes where users can play alone, in a clan or in five-on-five matches, all in real-time. The latest game targets global action game fans, and comes with fast-paced service, high quality graphics, as well as various missions and reward systems for more challenge. Netmarble’s

Sept. 1, 2016

-

[HANJIN CRISIS] Hanjin Shipping files for court receivership

[THE INVESTOR] Debt-ridden Hanjin Shipping on Aug. 31 filed for a court-led restructuring scheme, after its creditors decided to halt their financial support to the shipper. Seoul Central District Court said it has received the application for court receivership from South Korea’s No.1 container carrier and the world’s seventh largest by capacity. According to the official with the court, it will soon call in Hanjin Shipping’s executives to discuss the process of receivership, given the seriousn

Aug. 31, 2016

-

Renault Samsung expects QM6 to drive sales

[THE INVESTOR] Renault Samsung Motors, the local unit of French automaker Renault, unveiled its new sport utility vehicle QM6 on Aug. 31 saying it expects to see a boost in sales this year. “Last year, we barely exceed 8,000 units in sales,” Park Dong-hoon, CEO of Renault Samsung, told the media at the QM6 unveiling event in Seoul. “This year we expect to reach 110,000 units. For QM6, we will sell at least 5,000 units each month,” he said. Renault Samsung Motors’ QM6The QM6 SUV, a new version o

Aug. 31, 2016

-

[HANJIN CRISIS] Hanjin Shipping fallout stirs fear of W1tr loss to taxpayers

[THE INVESTOR] More than 1 trillion won (US$896.82 billion) of South Korean taxpayer’s money is expected to be lost as a result of Hanjin Shipping entering court receivership, local news reported on Aug. 31. According to creditors, state-run Korea Development Bank -- the largest lender of Hanjin Shipping -- will incur a loss of 660 billion won, while Korea Credit Guarantee Fund will lose 430 billion won. Once Hanjin Shipping’s receivership is approved by the court, the authorities will freeze a

Aug. 31, 2016

-

[HANJIN CRISIS] Hyundai Marine considers acquiring Hanjin Shipping’s good assets

[THE INVESTOR] The South Korean government on Aug. 31 said it will seek ways for Hyundai Merchant Marine to take over some of Hanjin Shipping’s profitable assets, including vessels, network and key personnel. “Hanjin Shipping’s court receivership decision raised concerns that it will weaken the competitiveness of South Korea’s shipping industry,” Financial Services Commission Vice Chairman Jeong Eun-bo said. “We will actively seek ways for HMM to take over Hanjin Shipping’s healthy assets, inclu

Aug. 31, 2016

![[HANJIN CRISIS] Hyundai Marine considers acquiring Hanjin Shipping’s good assets](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/31/20160831001017_0.jpg&u=20160831140643)

-

[HANJIN CRISIS] Will Hanjin Shipping revive or dismantle?

[THE INVESTOR] Market watchers are concerned on the fate of Hanjin Shipping in the wake of the shipper’s decision to enter court receivership. Hanjin Shipping on Aug. 31 reached an agreement to file for court receivership following the creditors’ decision that halted financial support the previous day. Once Hanjin Shipping enters court protection, the court is left with the choice of either reviving or liquidating the shipper. Related story: Hanjin Shipping to file for court receivershipAccordi

Aug. 31, 2016

![[HANJIN CRISIS] Will Hanjin Shipping revive or dismantle?](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/31/20160831000938_0.jpg&u=20160831133616)

-

[HANJIN CRISIS] Hanjin Shipping to file for court receivership

[THE INVESTOR] Hanjin Shipping will file for court receivership on Aug. 31, as its creditors refused to finance the debt-ridden container carrier. At the emergency meeting early in the morning, the board members of Hanjin Shipping reached a consensus to file for court protection at the Seoul Central District Court in the afternoon. On Aug. 30, the creditor banks -- led by state-run Korea Development Bank -- reached an agreement to stop funding the shipper, saying its latest self-rescue plan did

Aug. 31, 2016

![[HANJIN CRISIS] Hanjin Shipping to file for court receivership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/31/20160831000552_0.jpg&u=20160831133653)

-

[HANJIN CRISIS] FSC chief rules out Hanjin-Hyundai merger

[THE INVESTOR] Financial Services Commission Chairman Yim Jong-yong on Aug. 30 ruled out the possible merger between ailing shippers Hanjin Shipping and Hyundai Merchant Marine. “In current circumstances, (the merger) is not possible,” Yim told reporters at an event hosted by Korea Financial Telecommunications & Clearings Institute. “While a merger can create a competitive company, it can also worsen when a weak and strong (company) mix together. The creditors already considered the possibility

Aug. 30, 2016

![[HANJIN CRISIS] FSC chief rules out Hanjin-Hyundai merger](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/30/20160830001259_0.jpg&u=20160830173409)

-

[HANJIN CRISIS] Hanjin Shipping fallout has less impact on finance industry

[THE INVESTOR] The latest decision of debt-ridden Hanjin Shipping’s creditors to stop financing it will not greatly affect the finance industry as the lenders have already made allocations for bad debts to protect themselves from the fallout, market watchers say. According to local news report on Aug. 30, the creditor banks -- which include state-run Korea Development Bank and KEB Hana Bank -- extended a combined 1.02 trillion won (US$912.48 billion) loans to South Korea’s top container carrier

Aug. 30, 2016

![[HANJIN CRISIS] Hanjin Shipping fallout has less impact on finance industry](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/30/20160830001181_0.jpg&u=20160831173854)

-

[HANJIN CRISIS] Hanjin Shipping faces possible court receivership

[THE INVESTOR] Creditors of debt-ridden Hanjin Shipping decided on Aug. 30 to stop injecting funds to enable it to stay afloat, which may likely force the shipper to enter court receivership. The creditor banks, which include state-run Korea Development Bank and KEB Hana Bank, unanimously decided to stop supporting South Korea’s largest container carrier during their emergency meeting, saying its latest self-rescue plan did not fulfill the requirements. “Hanjin Shipping’s proposal fails to cover

Aug. 30, 2016

![[HANJIN CRISIS] Hanjin Shipping faces possible court receivership](//res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/30/20160830000910_0.jpg&u=20160830172757)

-

Hanjin Shipping’s fate to be decided on Aug. 30

[THE INVESTOR] Creditors of financially ailing Hanjin Shipping will decide on Aug. 30 whether to put the nation’s largest container carrier under court receivership. The creditors -- led by state-run Korea Development Bank -- will convene a meeting at 11 a.m. to decide whether to inject more funds into Hanjin Shipping or send the shipper for court receivership. They will announce the decision by afternoon, an official with the creditors said. Last week, Hanjin Shipping submitted a fresh self-res

Aug. 30, 2016

![[HANJIN CRISIS] Hyundai Marine considers acquiring Hanjin Shipping’s good assets](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/31/20160831001017_0.jpg&u=20160831140643)

![[HANJIN CRISIS] Will Hanjin Shipping revive or dismantle?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/31/20160831000938_0.jpg&u=20160831133616)

![[HANJIN CRISIS] Hanjin Shipping to file for court receivership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/31/20160831000552_0.jpg&u=20160831133653)

![[HANJIN CRISIS] FSC chief rules out Hanjin-Hyundai merger](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/30/20160830001259_0.jpg&u=20160830173409)

![[HANJIN CRISIS] Hanjin Shipping fallout has less impact on finance industry](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/30/20160830001181_0.jpg&u=20160831173854)

![[HANJIN CRISIS] Hanjin Shipping faces possible court receivership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=649&simg=/content/image/2016/08/30/20160830000910_0.jpg&u=20160830172757)